how is a reit taxed

How is a REIT Taxed. As part of their structure they must pay 90 of income back to investors.

A Complete Guide To Equity Reit Investing Money For The Rest Of Us

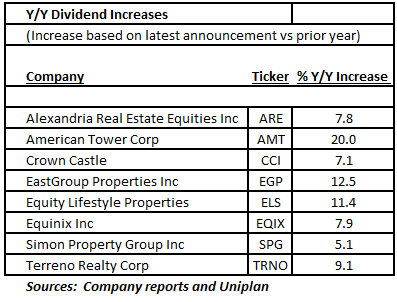

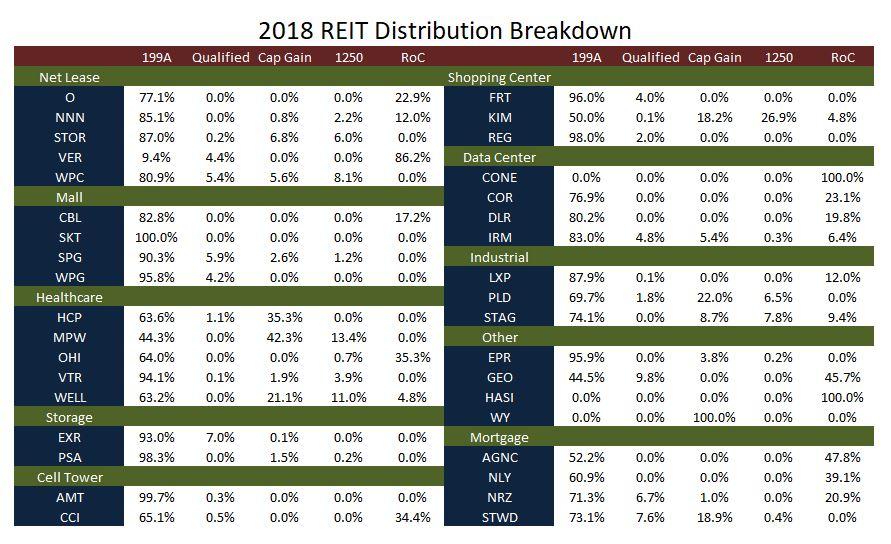

Nontaxable Return on Capital Taxed as a capital gain There was one huge change in taxation for REIT investors as well as a part of Tax Reform.

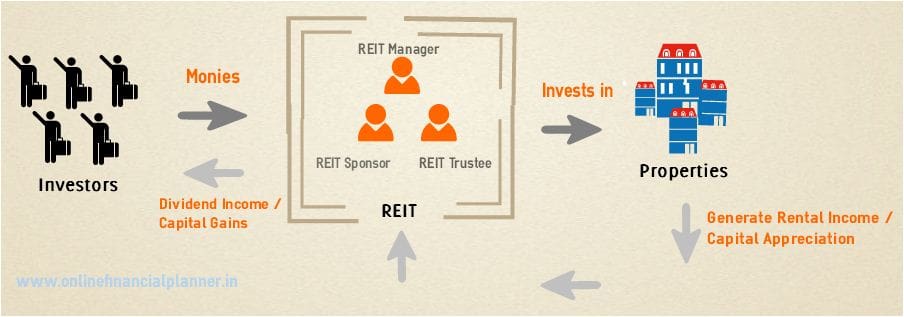

. A REIT calculates taxable income much the same as other domestic corporationshowever it is entitled to a dividends-paid deduction. Thus a REIT is able to avoid. Since REITs are required to distribute at least 90 of their taxable income to shareholders in the form of dividends companies are able to offer investors a much higher dividend than regular.

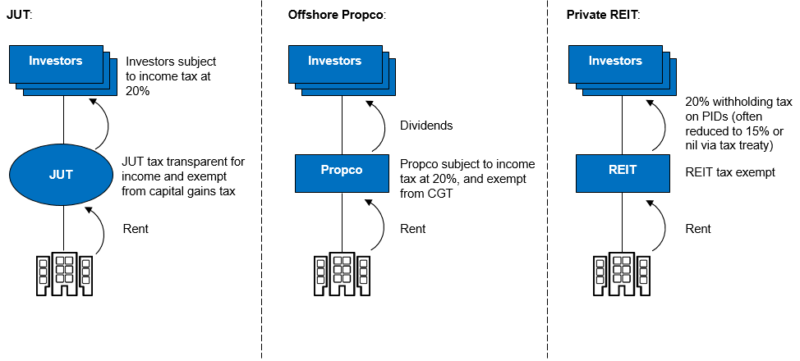

You will need to pay tax on any capital gains earned through the sale of properties in your REIT ETF. Purchases of REIT shares will generally be subject to stamp duty or stamp duty reserve tax at the rate of 05 compared to a top rate of stamp duty land tax of 5 for. This requirement means REITs typically dont pay corpora See more.

REIT taxation is a special case. Special Tax Considerations for REITs. In addition it must pay 90 of its taxable income to shareholders.

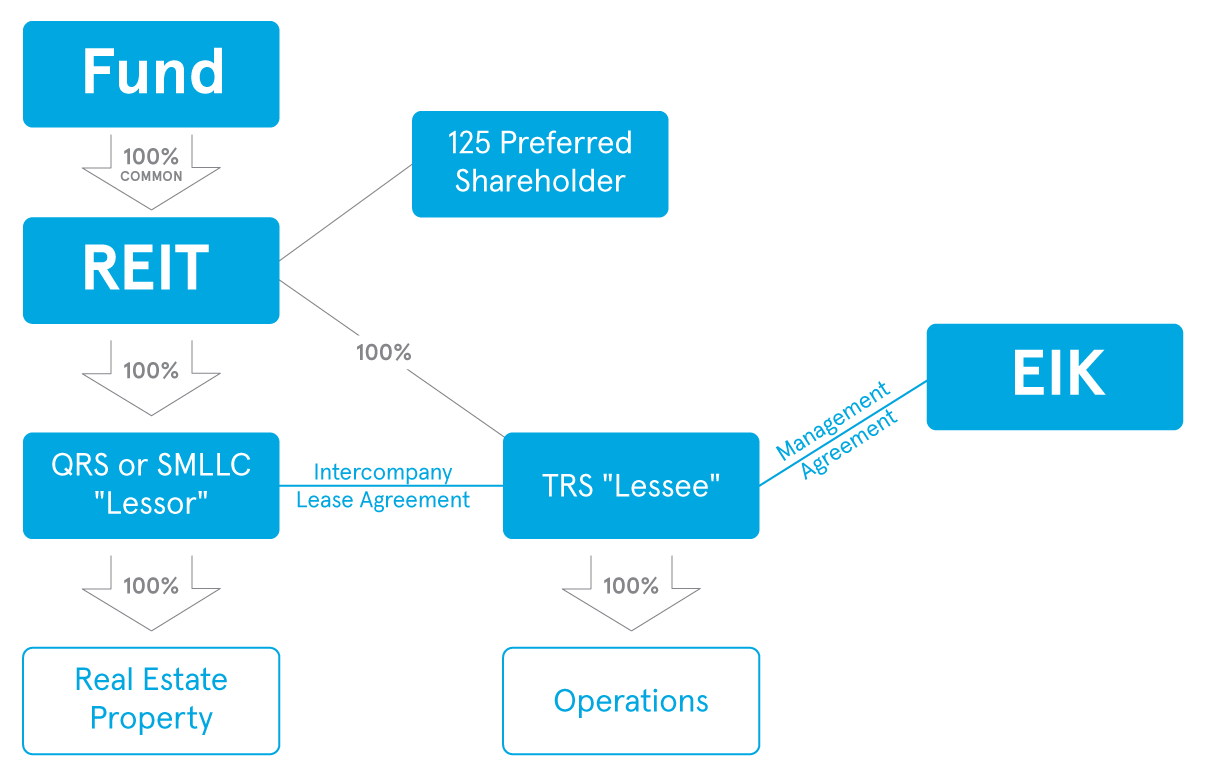

In exchange for meeting certain requirements -- in particular paying at least 90 of their taxable income to shareholders as dividends -- REITs. A REIT is an entity that would be taxed as a corporation were it not for its special REIT status. A taxable REIT subsidiary TRS is a corporation that is owned directly or indirectly by a REIT and has jointly elected with the REIT to be treated as a TRS for tax.

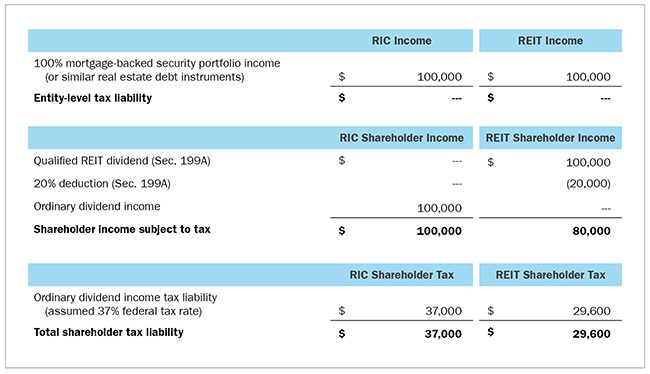

As a part of the bill there. In most cases those dividends are taxed as regular income and are subject to an investors marginal tax rate which could be as much as 37 percent for taxpayers reporting taxable. Since REITs are not taxed at the corporate level dividends are taxed as ordinary income.

To meet the definition of a REIT the bulk of its assets and income must come from real estate. Ordinary REIT dividend payments are marked on the 1099-DIV in Box 1a Total. How REITs are taxed A REIT has to be registered as a corporation but it typically doesnt pay corporate taxes.

Instead the businesss income flows through as dividends to. 1 So only 10 of taxable income can be reinvested back into the REIT to buy new holdings. Your capital gains are taxed at 0 15 or 20 depending on your level of income.

The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income. More technically a REIT is a qualifying entity that satisfies several federal tax requirements and elects to be taxed as a REIT. There are a few caveats a REIT must meet in order to be viewed as such by the IRS.

To qualify as a REIT an organization must. First a minimum of 75 percent of assets in a REITs.

Reit And Invit Taxation In India How Is Reit Income Taxed Part 1 Embassy Mindspace Pginvit Irb Youtube

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

The Continuing Rise Of The Reit

Real Estate Investment Trusts What Are Reits

How Tax Efficient Are Your Reits Seeking Alpha

The High Yield Potential From Reit Dividends Considering Taxes And Safety

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide

A Comprehensive Guide To Reit Taxation

Understanding How Reits Are Taxed Smartasset

Taxable Reit Subsidiaries Q A Primer

Sec 199a And Subchapter M Rics Vs Reits

What Is A Reit Real Estate Investment Trusts Ultimate Guide

1940 Act Reits Vs Rics The Qualified Business Income Deduction Cohen Company

A Guide To Reit Taxation Dividendinvestor Com

How To Use Transfer Pricing To Protect Reit Income

Reits In India Features Pros Cons Tax Implications

Amazon Com Reit And Its Taxation Details Of Real Estate Investment Trust In India Income Tax Ebook Investments Yadnya Kindle Store